Form CSR-1

The Ministry of Corporate Affairs (MCA) mandated entities undertaking Corporate Social Responsibility (CSR) to file eForm CSR-1 for all their CSR projects from 1 April 2021. The NGOs must register with the Central Government to undertake CSR activities funded by corporations and companies. This registration ensures effective monitoring of the CSR spending in the country.

Section 135 of the Companies Act, 2013 (‘Act’) and Rule 4(1) and Rule 4(2) of the Companies (Corporate Social Responsibility Policy) Amendment Rules, 2021 (‘Rules’) provides that the companies or entities that undertake CSR activities have to mandatorily register with the Central Government by filing the eForm CSR-1.

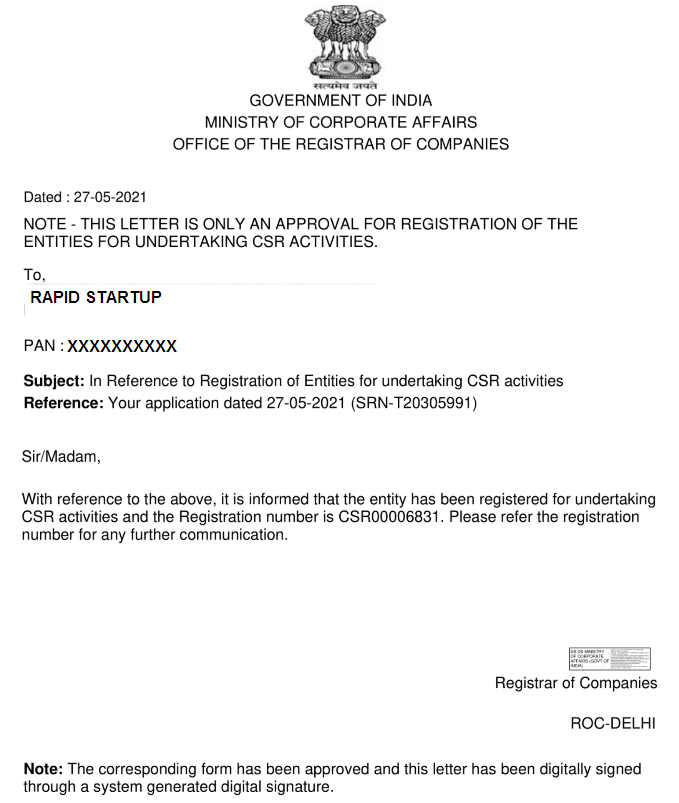

Sample-

Applicability of Form CSR-1

The Rules provides that a Board of a company should ensure the company itself undertakes the CSR activities or through:

- A registered society, registered public trust, Section 8 company or established under Section 12A and 80G of the Income Tax Act, 1961, incorporated by the company.

- A company registered under Section 8 of the Act, a registered society or registered trust established by the Central or State Government.

- Entities established under a State Legislature or Act of Parliament.

- A Section 8 company, registered society, registered public trust or company registered under Section 12A and 80G of the Income Tax Act with an established track record of at least three years in undertaking similar activities.

Thus, a company can undertake a CSR activity on its own or through a company registered under Section 8, registered society, public trust or an NGO as mentioned above. All these entities mentioned above or the company that intends to undertake a CSR activity should mandatorily register themselves with the Registrar of Companies by filing the Form CSR-1 electronically.

Contents of Form CSR-1

Form CSR-1 is a form for registering entities to get CSR funding from the corporates and undertake CSR activities. The contents to be filled in Form CSR-1 are:

- Nature of the entity.

- CIN number or registration number of the entity.

- Date of Incorporation, address and email ID of the entity.

- PAN of the entity.

- Details of directors, chairman, board of trustees, secretary, CEO or authorised representatives of the entity.

- DIN (Director Identification Number) and DSC (Digital Signature Certificate) of the signing director.

- Certification by a practising professional.

Documents Required for Form CSR-1

- Copy of PAN card of the entity.

- Copy of registration certificate of the entity.

- Copy of 12A and 80G exemption certificate, if applicable.

- NGO darpan ID, if applicable.

- DSC of the authorised person signing the form.

- PAN of the authorised person signing the form.

- Company CSR policy.

- Company CSR report.

- Details of the subsidiary and other entities.