This is with respect to New / Renewal* of 12A / 80G and CSR-1,NGO Darpan, E anudaan, Udyog adhar registrations of Non-Governmental Organizations (NGOs) like Charitable Trusts, Charitable Societies or Section 8 Companies under the provisions of income-tax, 1961 for claiming various benefits as discussed below in the email.

What is the 12A and 80G?

12A and 80G are the two registrations granted by the Income Tax Department to NGOs to allow them in Tax Exemption and permitting Deduction on Donations by the donors. A 12A and 80G registered NGO is more acceptable to receive funding and various tax reliefs.

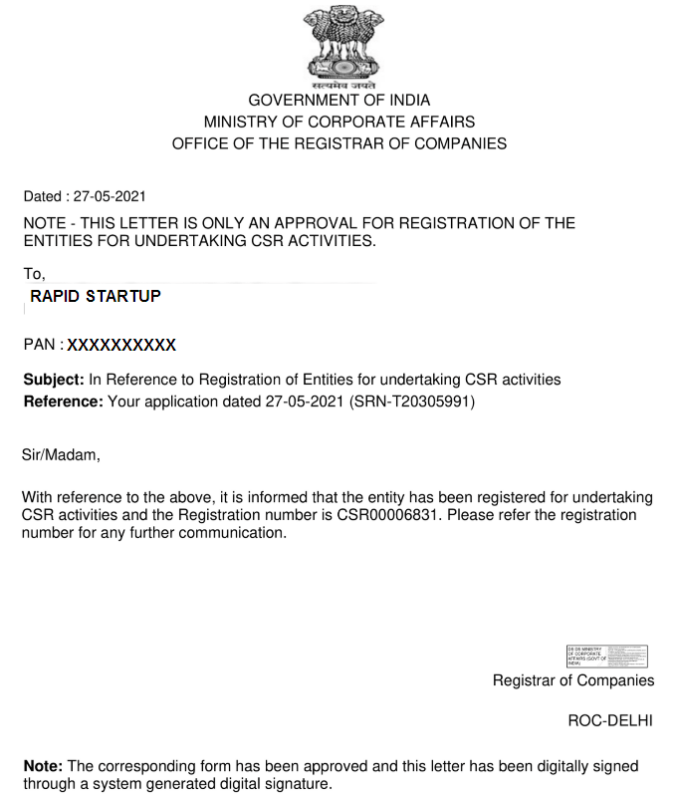

What is the CSR-1?

The Ministry of Corporate Affairs (MCA) mandated entities undertaking Corporate Social Responsibility (CSR) to file eForm CSR-1 for all their CSR projects from 1 April 2021. The NGOs must register with the Central Government to undertake CSR activities funded by corporations and companies. This registration ensures effective monitoring of the CSR spending in the country.

Section 135 of the Companies Act, 2013 (‘Act’) and Rule 4(1) and Rule 4(2) of the Companies (Corporate Social Responsibility Policy) Amendment Rules, 2021 (‘Rules’) provides that the companies or entities that undertake CSR activities have to mandatorily register with the Central Government by filing the eForm CSR-1.

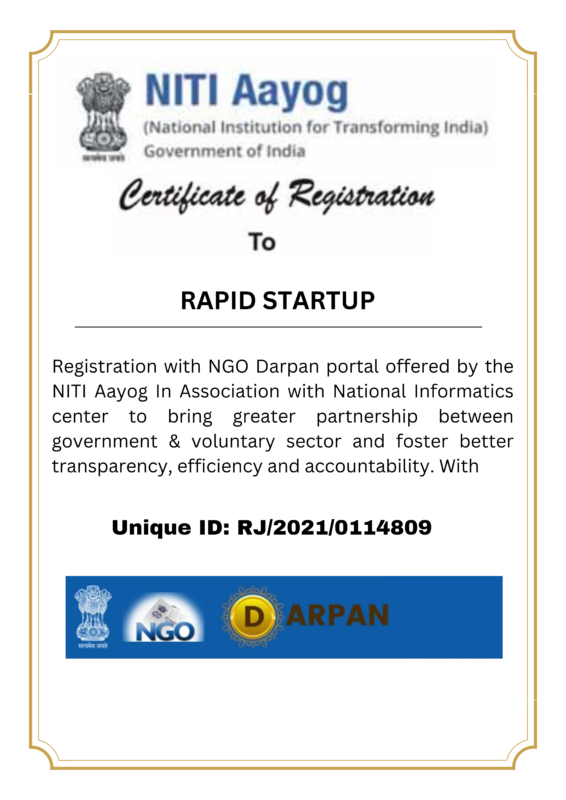

NGO-DARPAN

NGO-DARPAN is a platform that provides space for interface between VOs/NGOs and key Government Ministries / Departments /Government Bodies, to start with. Later it is proposed to cover all Central Ministries / Departments / Government Bodies.

This facility offered by the NITI Aayog in association with National Informatics Centre to bring about greater partnership between government & voluntary sector and foster better transparency, efficiency and accountability.

The NGO-DARPAN started out as an initiative of the Prime Minister’s Office, to create and promote a healthy partnership between VOs/NGOs and the Government of India. The Portal is managed at present by NITI Aayog.

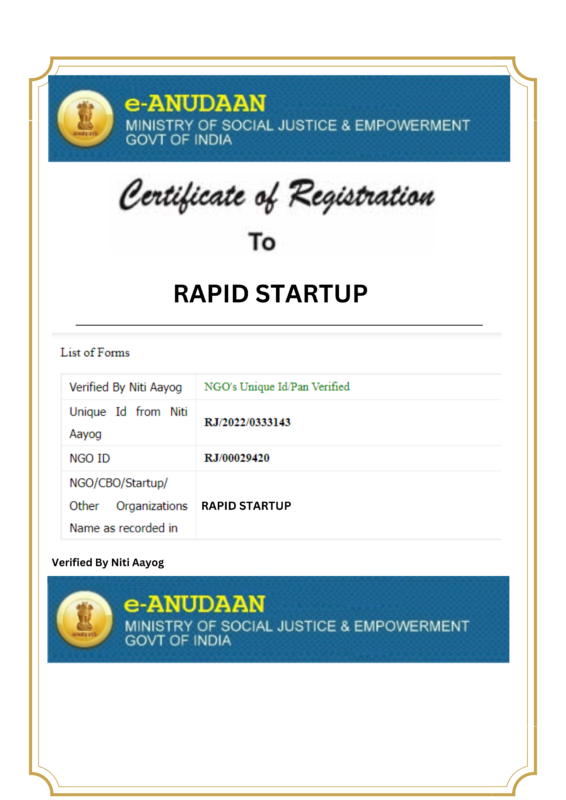

e-Anudaan – Ministry Of Social Justice And Empowerment

e-Anudaan is an initiative by Ministry Of Social Justice And Empowerment to enable Non-Government Organizations (NGOs) to register online and log in to apply for Grant-in-aid to help implement various schemes of the Ministry

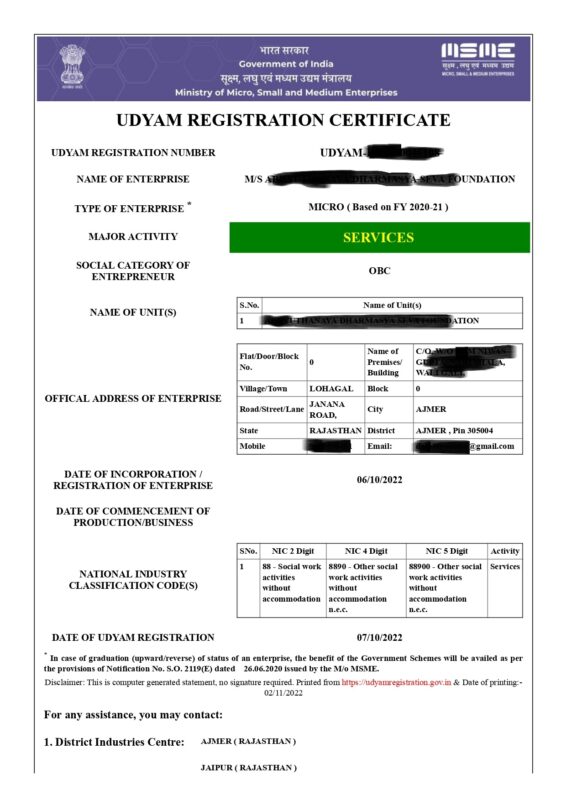

Udyog Aadhaar

The Ministry of Micro, Small and Medium Enterprises, Government of India has started a unique document for micro, small and medium sized enterprises in India. It is a 12-digit Unique Identification Number (UIN) also called Udyog Aadhaar or Aadhaar for Businesses, MSME Registration, etc. Moreover, Udyog Aadhaar Certificate is also provided by the Government to certify Micro, Small and Medium Enterprises.

Benefits of Udyog Aadhaar

Following are the benefits of Udhyog Aadhaar:

- Helps in providing bank loan without collateral or mortgage

- Helps in tax exemption of direct tax

- You can avail interest at lower rate

- In case of patent registration 50% grant is available

- Reimbursement of ISO certification

- Makes the process of availing licences, approvals and other registrations easy

Docs Required

Society pan card ya section 8 COI pan card

Society deed/aoa ,moa

Society any member/chairman adhar card pan card